- August 8, 2024

- Category: Crypto

In a constantly changing industry, a creative and reliable approach is required for any crypto project to become sustainable and relevant. Cash-flow provision is one of the solutions. It is a strong weapon that facilitates projects to pass obstacles related to finance and move towards ambitious goals, reach challenging objectives, and make their dreams real.

Understanding the Power of Cash Flow Provision

What would happen to your project if you added more money to it? Could you imagine opening doors that were impossible to open before? A cash-flow provision is just that. By providing access to borrowed funds, it acts as a catalyst for:

- Exponential Growth: These extra resources provide fuel for projects to accelerate their development roadmap, enlarge and expand teams, and introduce advanced features of the company.

- Enhanced Marketing Reach: Having more money means having greater power for advertising projects to invite a larger customer population.

- Market Adaptability: Cash-flow provision is what makes a project more responsive in the market that it operates in; such as quickly responding to the changes or taking advantage of new opportunities while dealing with possible risk.

- Increased Market Liquidity: Cash flow management provides smoother transactions as well as a greater dynamic and diverse trading environment for the whole ecosystem by injecting more capital into the ecosystem.

Delving into the Mechanics

The specific mechanics of cash-flow provision may vary depending on the provider, but the general process follows a well-defined structure:

- Application and Approval: Projects apply for a margin account with the preferred provider.

- Collateral Deposit: To secure against risk, projects post part of their crypto assets as collateral to make sure that the loans are backed up.

- Borrowing Crypto Assets: Projects get access to a given amount of capital corresponding to the value of their collateral.

- Position Management: Active oversight of the lends and careful oversight of risks help against margin calls and ensure fiscal health.

- Loan Repayment: Projects make payment of the loan and its interest following the set deadline.

Key Differences Between Loans, Borrows, and Cash Flow Provision

Some of Cash Flow mechanics sure look similar to loans or borrows, and share the same goal, but there are significant differences between the three. Here’s a breakdown of the key differences:

Purpose:

- Loans: Borrowing money, which is used to get assets and incur costs.

- Borrows: Short-term loans or financing agreements usually collateralized, employed for leveraged trading and hedge strategies.

- Cash-flow provision: Offers margin lending that is tailored for crypto traders and projects who can borrow crypto assets against deposit collateral.

Collateral:

- Loans: These are usually supported by traditional assets such as property or securities.

- Borrows: Typically, these are crypto-backed loans with more risks.

- Cash-flow provision: Collateral requirements vary based on the provider and project, but typically involve a significant amount of crypto holdings.

Interest Rates:

- Loans: The interest rate is generally fixed according to the lender’s evaluation of risk and the market condition.

- Borrows: The interest rate can be constant or vary and depends on the provider and nature of lending.

- Cash-flow Interest rates can be more flexible including the project’s creditworthiness and collateral value.

Repayment Terms:

- Loans: With specific payment schedules characterized by fixed installments.

- Borrows: These could be payable in shorter installments or offered on friendly repayment terms.

- Cash-flow provision: Repayment plans often have fixed rates, while others allow clients to make periodic payments, and others even permit early settlements.

Suitability:

- Loans: Suitable for funding projects that typically have consistent cash inflows over extended periods.

- Borrows: Useful for short-term trading or hedging.

- Cash-flow provision: Great support especially those crypto projects that may want to grow fast, expand their business, or fund their marketing activities.

There are several reasons why you might choose to use cash-flow provision instead of a loan or borrowing. Let’s dive deeper into the pros and cons of cash flow provision

Benefits of cash-flow provision

1. It can provide you with access to additional capital without the need to go through a traditional loan process. This can be helpful if you need funding quickly or if you don’t have the credit history to qualify for a traditional loan.

2. It can allow you to use your crypto assets as collateral, which can be a more attractive option than using traditional assets like property or securities. This is because crypto assets can appreciate over time, which can increase the amount of capital you have access to.

3. It can offer you more flexibility in terms of how you use the funds. You can use the borrowed crypto assets to trade, invest, or expand your operations.

4. It can help you to improve your liquidity. This is because you can use the borrowed crypto assets to trade or invest, which can increase the value of your portfolio.

Drawbacks of cash-flow provision

1. It can be more volatile than traditional loans. This is because the value of your collateral can fluctuate, which can lead to margin calls.

2. You’ll need to carefully manage your risk exposure. This is because you’ll be using borrowed money, which means that your losses can be amplified.

3. You’ll need to make regular payments to the provider. This is typically in the form of interest and fees.

In general, cash flow provision could become an effective instrument for growing a crypto project, making it competitive in the markets. However, it is important to carefully consider the risks involved before using this product.

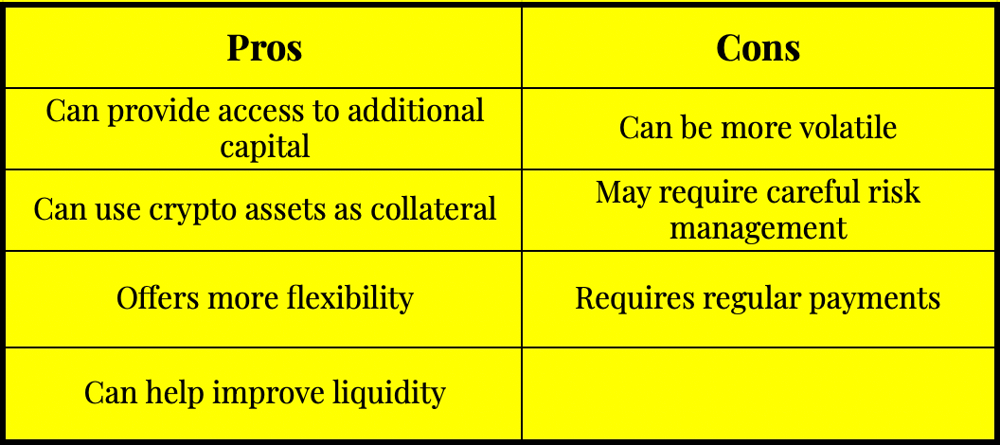

Here is a table summarizing the pros and cons of cash-flow provision:

Embracing the Advantages for Crypto Projects

Access to reliable and timely cash flow in this increasingly competitive crypto economy can be a real game changer. Here’s why:

Unleashing Growth Potential: A business firm can utilize extra capital for quickened development of cycles, introduction of innovations earlier, and realization of ambitious tasks earlier within a comparatively short period.

Enhanced Market Competitiveness: As an outcome, cash flow provision gives financial strength to the project with which it can beat competitors, attract the best talents, and promote a healthier, stronger, and much more dynamic ecosystem.

Building Investor Confidence: Projects become more appealing to investors when they can show that they are capable of accessing reliable cash flow.

Sustainable Future: Proper financial management and weathering of market changes through cash-flow provision services secures project longevity and augments its survival prospects amidst a dynamic crypto environment.

Navigating the Risks with Prudence

While cash-flow provision offers a multitude of benefits, it’s crucial to approach it with a keen awareness of potential risks:

Leverage Amplification: Therefore, just like with every levered product, both profits and losses can be magnified. Projects should learn the art of taking precautions by exposing themselves moderately and implementing effective risk management.

Liquidation Risk: If the value of the collateral is less than some critical level, it might be sold for purposes of covering up the debt, and this could result in huge losses. Thus, projects need to have enough collateral and keep track of the dynamics in the market.

Interest Costs: Moreover, borrowed funds attract interest that ultimately influences the cost-effectiveness of the entire undertaking. When it comes to using cash-flow provision services, projects have to be careful about interest costs to assess financial sustainability.

Conclusion

For crypto projects aspiring to thrive in the dynamic and competitive landscape, mastering cash-flow provision is an essential skill. By understanding its mechanics, weighing the potential benefits against the associated risks, and choosing a reputable provider, projects can unlock a powerful tool to fuel their growth, enhance market competitiveness, and build a strong foundation for long-term sustainability. Remember, responsible usage and careful planning are key to unlocking the full potential of cash-flow provision and propelling your project towards a brighter future within the cryptoverse.

Feel free to contact Yellow Capital for a free consultation about crypto Cash Flow provision for your project.

Yellow Capital offers a variety of cash flow support options to help our partners make their crypto dreams real.

Add a comment

You must be logged in to post a comment.