- November 17, 2024

- Category: Crypto, Weekly Crypto Digest

In the latest issue of Weekly Crypto Digest, read about how Bitcoin reached $93K, MicroStrategy added 27K BTC, Trader Loses $25.8 Million Due to Address Error, XRP over $1, and more news.

Bitcoin Price Updated ATH at $93,000

BTC started the week below $80,000, but immediately began to grow. On Monday, November 11, digital gold tested $85,000, and the next day it continued to rise and approached $90,000. On Wednesday, November 13, the asset updated ATH at above $93,000. At the time of writing, Bitcoin was trading at around $90,000.

Most of the top 10 assets by capitalization ended the week with growth. XRP (+78.9%) and Dogecoin (+47.9%) added the most. The total capitalization of the cryptocurrency market is $3.17 trillion. The Bitcoin dominance index is 60.2%.

XRP Price Exceeds $1 for First Time in Three Years

On Saturday, November 16, XRP token quotes exceeded the psychological threshold of $1 for the first time since December 2021.

At the time of writing, XRP is trading at $1.02, up 83.8% over the past week.

According to CoinGecko, Ripple’s capitalization has reached $58 billion.

The asset is demonstrating the greatest sensitivity to news about the possible resignation of Gary Gensler as head of the SEC due to the long-standing litigation between Ripple and the regulator. The reason was the official’s statement, which many saw as preparation for such a scenario.

MicroStrategy Bought an Additional 27,200 BTC for $2.03 Billion

From October 31 to November 10, MicroStrategy acquired an additional 27,200 BTC for $2.03 billion (at a price of ~$74,463 per coin). This was reported by the company’s founder, Michael Saylor.

As of November 11, the company holds 279,420 BTC on its balance sheet, acquired for $11.9 billion at an average rate of $42,692. At the time of writing, these assets are valued at $22.87 billion.

Saylor also said that the creation of a strategic reserve in Bitcoin is “the best deal of the 21st century.” He expressed confidence that such a structure will appear in the United States.

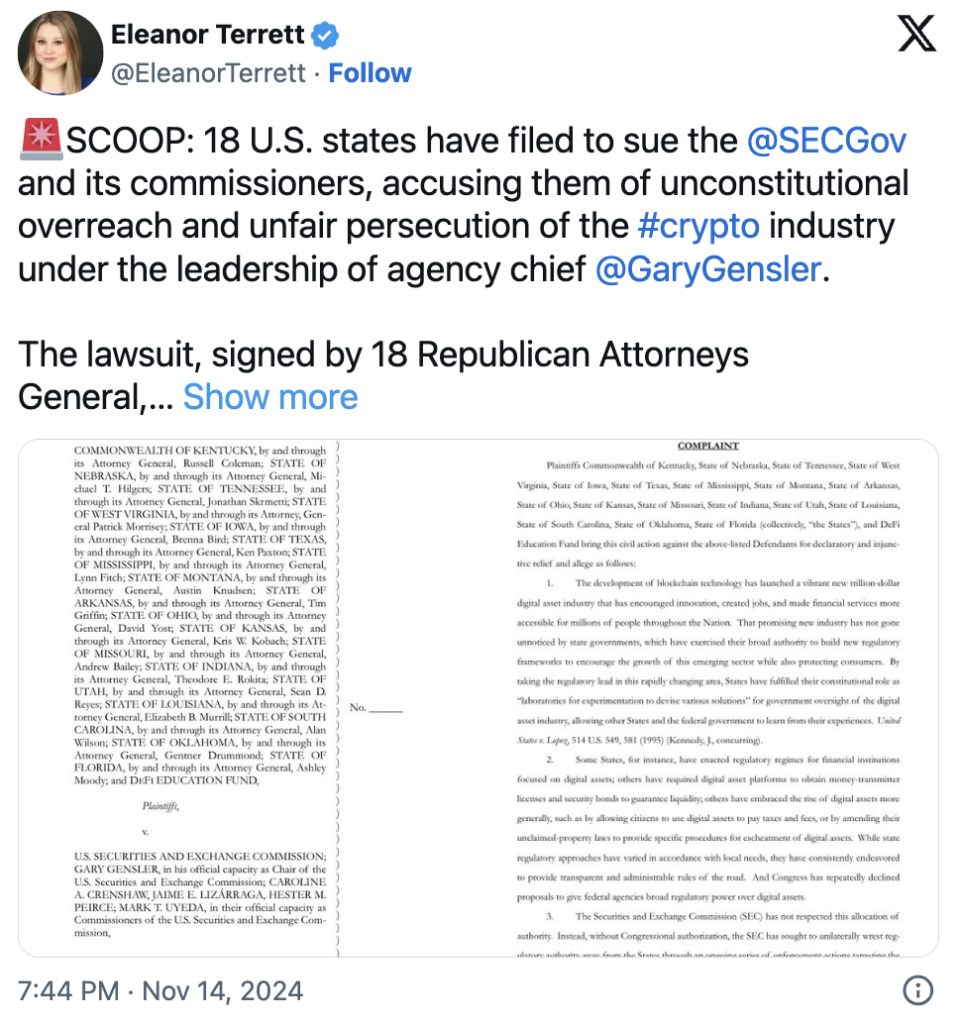

US Authorities Accuse the SEC of Persecuting the Crypto Industry

The attorneys general of 18 US states and the DEF have filed a lawsuit against the SEC and five of its commissioners, accusing them of unconstitutional abuse of power and unfair prosecution of the crypto industry. The materials were received by the District Court for the Eastern District of Kentucky. The document details how the regulator’s enforcement actions against bitcoin exchanges violated states’ right to self-regulate their economies.

The plaintiffs are asking the court to prohibit the Commission from filing further lawsuits against the industry.

Trader Loses $25.8 Million Due to Address Error

A user under the pseudonym qklpjeth lost access to 7,912 ezETH ($25.8 million at the time of writing) by sending them to the wrong address.

According to the victim, on June 19, he accidentally copied the wrong data and sent the tokens to a smart contract without the ability to withdraw. qklpjeth tried to resolve the issue with the help of Renzo developers, who could update the code and unlock the funds, but they were unable to help, citing “regulatory restrictions.”

On November 10, the user asked the community for help, promising 10% of the amount (~$2.5 million) as a reward for returning the funds.

Upbit Exchange Faces Fines of Up to $43 Billion for Violating KYC Procedures

South Korea’s largest cryptocurrency exchange, Upbit, is suspected of violating KYC procedures for 600,000 users.

The local regulator may fine the company $71,666 for each incorrect verification — potentially forcing the exchange to pay up to $43 billion. The platform may also not have its license renewed to operate in the country.

Add a comment

You must be logged in to post a comment.